LGBT

Photo: Nikola Jovanovic

It’s no longer news that the climate is changing and that we need to make some serious adjustments if we want to secure our planet for today and for our future generations. Research shows that with accelerating ice loss, deforestation, heat waves, and other detrimental effects of climate change, we are becoming increasingly close to reaching a tipping point after which the changes we’ve made will become irreversible. To make things more daunting, sub-$30 oil prices, the EPA’s open invitation to pollute, the failure of global leaders to commit to legally binding climate goals, and the delay of key climate talks are only going to exacerbate our impact on the environment. It’s clear we still have a long way to go and that the human race has a lot to gain from cleaning up our act.

© Stephen Dawson

AMPLIFYING PHILANTHROPIC IMPACT

So what role can philanthropy play in all this? The typical philanthropic approach to tackling climate change has been to make grants to nonprofit organizations working on an array of issues, from conservation to environmental research and advocacy. When climate related natural disasters hit, philanthropy often shines with a strong immediate response. This kind of traditional philanthropy is greatly needed and the impact of grants can be substantial — in 2019 alone, Tides granted almost $40 million to 521 organizations working on environmental issues. So, unless you’re using multi-year, patient grant capital (i.e. long-term grantmaking) to effectuate change, grantmaking can be somewhat ephemeral since grantmaking alone may not be enough to incentivise long-term, sustainable, and scalable shifts.

Short-term or long-term grantmaking, when combined with impact investing, however, can bring about the fundamental change required to secure the health of our planet. The result: environmental and social impact meets potential positive financial return. This hybrid approach incentivizes the ecosystem of changemakers working on climate solutions by supporting and scaling diverse, effective strategies that balance risk and reward, both financial and social.

100% of EFM’s funds are invested with the intention of creating tangible, and enduring social and environmental impact alongside robust financial returns. We do not believe that impact outcomes necessarily require sacrificing financial returns, in fact, our experience suggests that the two are inextricably linked and are mutually reinforcing.

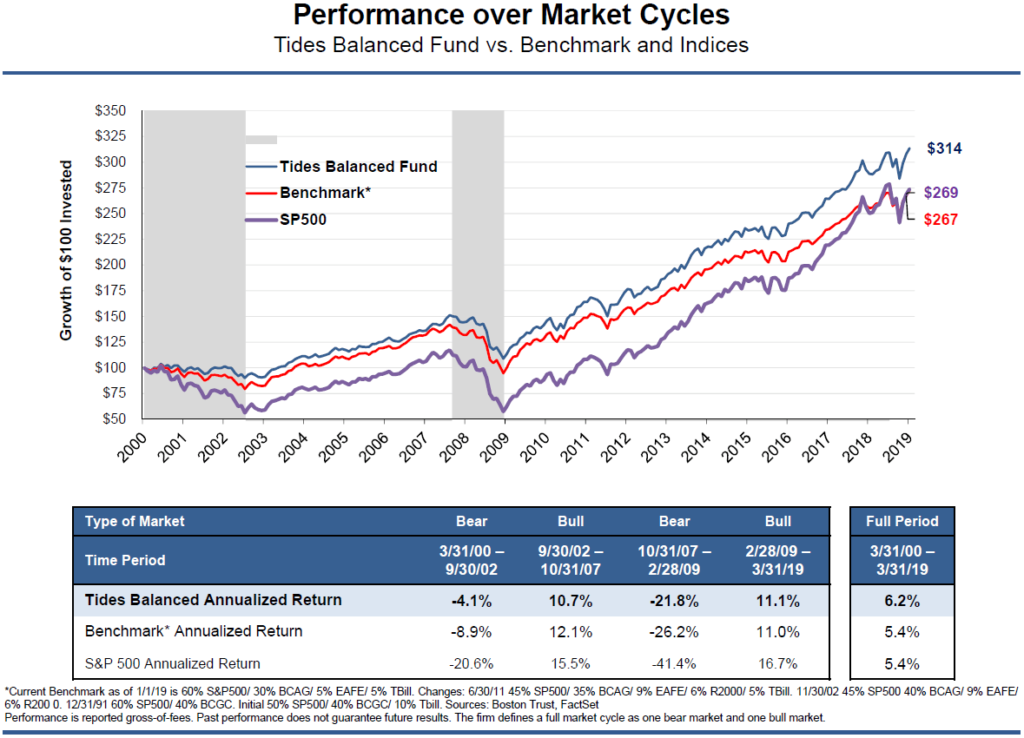

There are special vehicles that allow for this hybrid approach. Donor Advised Funds (DAFs) at Tides Foundation are used for thematically investing in environmental assets as well as for grantmaking to those working on the front lines of the climate crisis. From a financial standpoint there is a clear case to be made for impact investments across various asset classes. For example, Tides’ Balanced Fund, a blended strategy, has thrived through multiple recessions and corrections since 1987. Even during the current muted interest rate period, community investor CNote has CDFI-based strategies producing returns between 2.5%-4%. Tides’ Balanced Fund is committed to environmental shareholder advocacy as one of its issue areas, whereas CNote can lend to communities most affected by climate change as well as entrepreneurs working towards climate solutions. These are just two examples that show it’s not always necessary to sacrifice financial return for impact.

Performance of the Tides Balanced Fund

Tides Balanced Fund vs. Benchmark and Indices

In 2019 and 2020 alone, Tides mobilized $11M in impact investments focused on the environment and we can help you navigate the complexity of impactful investments related to this issue area. Our DAFs are a powerful tool that enable you to do both from one charitable vehicle, and our results-driven approach to every partnership manifests in customizing solutions for partners focused on their particular interest-area.

Short-term or long-term grantmaking, when combined with impact investing, can bring about the fundamental change required to secure the health of our planet.

The following case studies are examples of some of the ways we are currently working with our partners to invest in the environment, namely climate change. All of these partners have an aligned grantmaking strategy, and we believe that they illustrate some of the creativity that is possible when combining impact investing with protecting our planet.

In 2019 alone, Tides granted almost $40 million to 521 organizations working on environmental issues.

While the field of impact investing is on an aggressive growth trajectory, the amount of capital deployed to climate change is far from optimal — and we must do more. From equities to fixed income to alternatives, Tides is proud to work in this space by sourcing new opportunities for partners who want a “hands-on” approach. Together, we can protect our climate for today and for future generations, one investment at a time.

—

If you are interested in learning more about impact investment opportunities that focus on climate and other environmental issues, please email [email protected].

LGBT

Corporate Partners

Philanthropy

Read the stories and hear the voices of social change leaders fighting for justice.